Blog categorized as IndusInd Credit Cards

The IndusInd Bank PIONEER Private Credit Card is an invite-only ultra-premium metal card for Pioneer Private clients, offering 0% forex markup, unlimited lounges and golf, Taj/ITC memberships, luxury travel perks, and rich milestone rewards—best suited for very high spenders.

Author And Publisher: Gyro 3.o

29.11.2025 02:43 PM - Comment(s)

The IndusInd Bank Pioneer Legacy Credit Card offers ₹1.97 lakh annual value with 4 golf games/month, 8 international and 4 domestic lounge visits, 3 monthly BOGO offers, 1.8% forex markup, travel insurance up to ₹25L, and concierge. It suits achievers seeking luxury travel and lifestyle benefits.

Author And Publisher: Gyro 3.o

28.11.2025 01:05 PM - Comment(s)

IndusInd Bank Pioneer Heritage is an ultra-premium metal card offering zero forex markup, strong lounge, golf, dining and concierge benefits, plus luxury gifts, but with very high fees and devalued ITC membership for new applicants after Sept–Oct 2025, suiting only high-spend lifestyle users.

Author And Publisher: Gyro 3.o

28.11.2025 11:11 AM - Comment(s)

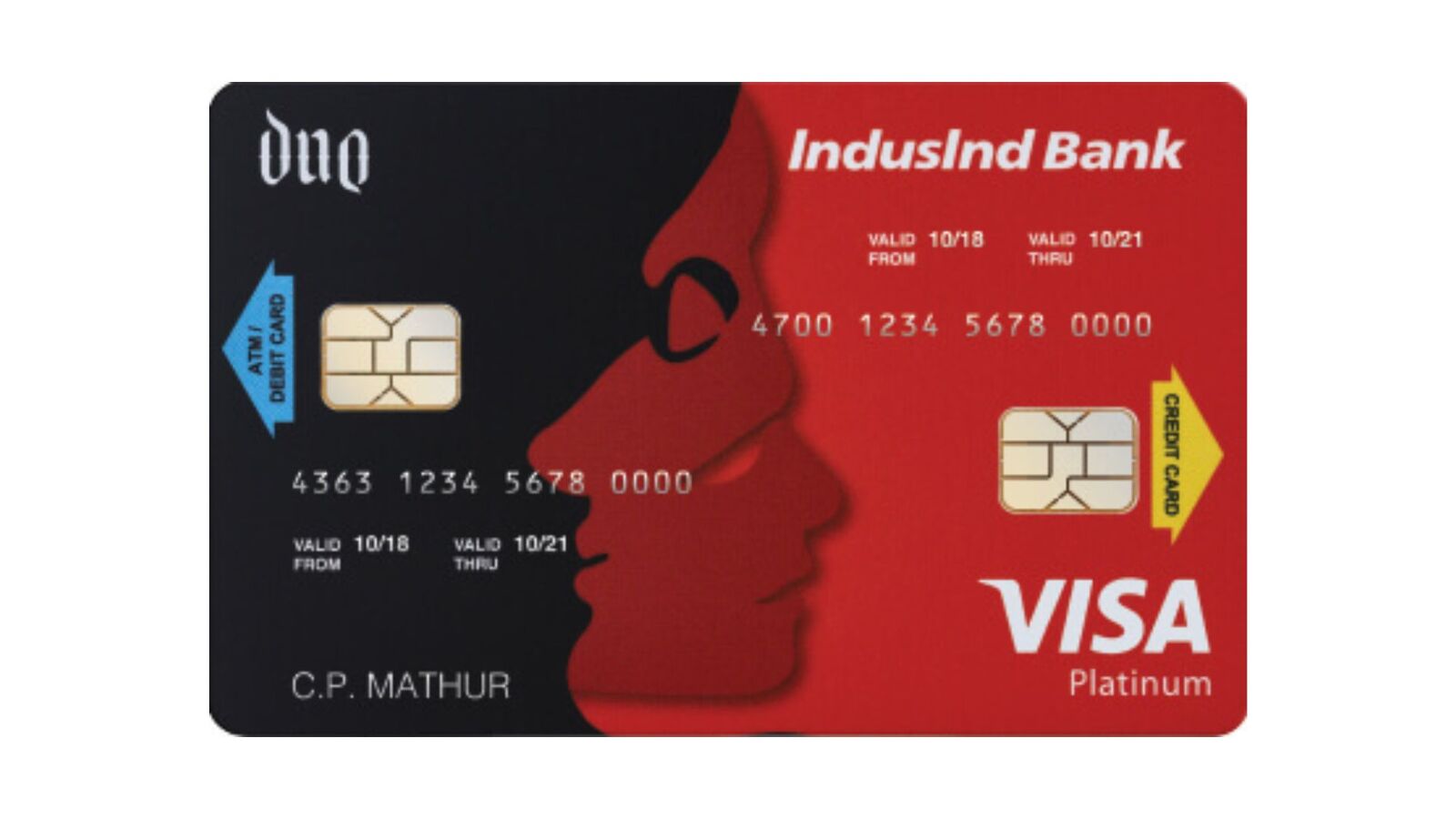

IndusInd Duo is India’s first hybrid debit-credit card with dual chips. It includes ₹3,000 annual movie tickets, ₹25L air accident insurance, and a 2% forex markup. Rewards are capped with an effective 0.5% rate, ideal for users valuing convenience and security over high rewards.

Author And Publisher: Gyro 3.o

27.11.2025 05:06 PM - Comment(s)

IndusInd Indulge: 22K Gold, NPSL, Unlimited Golf (Regular), 40 lounge visits/year, 1.5% rewards, 1.8% forex. Luxury for high-spenders who maximize golf & travel. Fees high if ₹10L spend is missed.

Author And Publisher: Gyro 3.o

27.11.2025 11:24 AM - Comment(s)

Ultra-premium card for Vistara loyalists. Key perks: ₹40K fee, up to 8 CV points per ₹200, and 5 Business Class vouchers. CRITICAL: Card discontinued due to Air India merger. Benefits cease March 31, 2025. Current applicants are not accepted

Author And Publisher: Gyro 3.o

21.11.2025 09:39 PM - Comment(s)

IndusInd Bank ePay Amex offers transaction-based rewards, Zomato Gold, Times Prime, 5% early payment cashback, and fraud cover—best for frequent disciplined spenders, but limited perks, ₹500 min spend, and Amex acceptance constraints.

Author And Publisher: Gyro 3.o

21.11.2025 08:31 PM - Comment(s)

Indus Solitaire Card: Ultra-premium card for affluent travelers/devotees. Features ZERO Forex, 32 annual lounge visits (4 domestic + 4 international per quarter), and Taj/EazyDiner memberships. High fees (₹30K joining, ₹10K annual—waived on ₹10L+ spend) require genuine high usage.

Author And Publisher: Gyro 3.o

19.11.2025 10:24 PM - Comment(s)

Poonawalla Fincorp IndusInd Bank eLITE RuPay Credit Card is lifetime free, ideal for digital and UPI users. Earn 2.5X rewards on e-commerce, BOGO movie tickets (₹200 cap), and ₹3K bonus on ₹4L spend. Great for domestic use with strong fraud protection but no lounge or global perks.

Author And Publisher: Gyro 3.o

19.11.2025 09:44 PM - Comment(s)

The CRED IndusInd Bank RuPay Card is for CRED members (750+ score) & online shoppers. It offers 5% back on e-commerce/CRED platform spends (capped) & UPI payments. Rewards are locked to the CRED ecosystem; no lounge access or international use.

Author And Publisher: Gyro 3.o

19.11.2025 08:58 PM - Comment(s)

Tiger Credit Card: Lifetime Free premium card best for high spenders & global travelers. Get up to 6X rewards, 1.5% Forex markup, 4 free golf games, 8 domestic, and 2 international lounge visits annually.

Author And Publisher: Gyro 3.o

19.11.2025 08:51 PM - Comment(s)

Exclusive to Govt employees, the IndusInd Samman RuPay Card offers 1% cashback, UPI integration, and fuel/rail surcharge waivers. With nil cash advance fees, travel insurance, and movie perks, it’s a practical, low-cost choice for steady savings and daily utility.

Author And Publisher: Gyro 3.o

19.11.2025 08:25 PM - Comment(s)

Exclusive to Govt employees, the IndusInd Samman RuPay Card offers 1% cashback, UPI integration, and fuel/rail surcharge waivers. With nil cash advance fees, travel insurance, and movie perks, it’s a practical, low-cost choice for steady savings and daily utility.

Author And Publisher: Gyro 3.o

19.11.2025 08:25 PM - Comment(s)

Exclusive to Govt employees, the IndusInd Samman RuPay Card offers 1% cashback, UPI integration, and fuel/rail surcharge waivers. With nil cash advance fees, travel insurance, and movie perks, it’s a practical, low-cost choice for steady savings and daily utility.

Author And Publisher: Gyro 3.o

19.11.2025 08:25 PM - Comment(s)

The IndusInd Bank Avios Visa Infinite Credit Card offers 61,000+ annual Avios, lounge access, forex discounts, concierge, and travel insurance—ideal for high-spending international travelers loyal to Qatar or British Airways. Fees undisclosed; best for ultra-premium users.

Author And Publisher: Gyro 3.o

19.11.2025 02:05 PM - Comment(s)

Categories

- Uncategorized

(1)

- HDFC Credit Cards

(15)

- SBI Credit Cards

(16)

- AXIS Credit Cards

(18)

- ICICI Credit Cards

(21)

- KOTAK Credit Cards

(27)

- Canara Credit Cards

(16)

- Yes Bank Credit Cards

(20)

- IDFC FIRST Credit Cards

(15)

- IndusInd Credit Cards

(21)

- BOB Credit Cards

(24)

- Discontinued Cards

(6)

- Federal Bank Credit Cards

(9)

- HSBC Credit Cards

(11)

- Standard Chartered Credit Cards

(10)