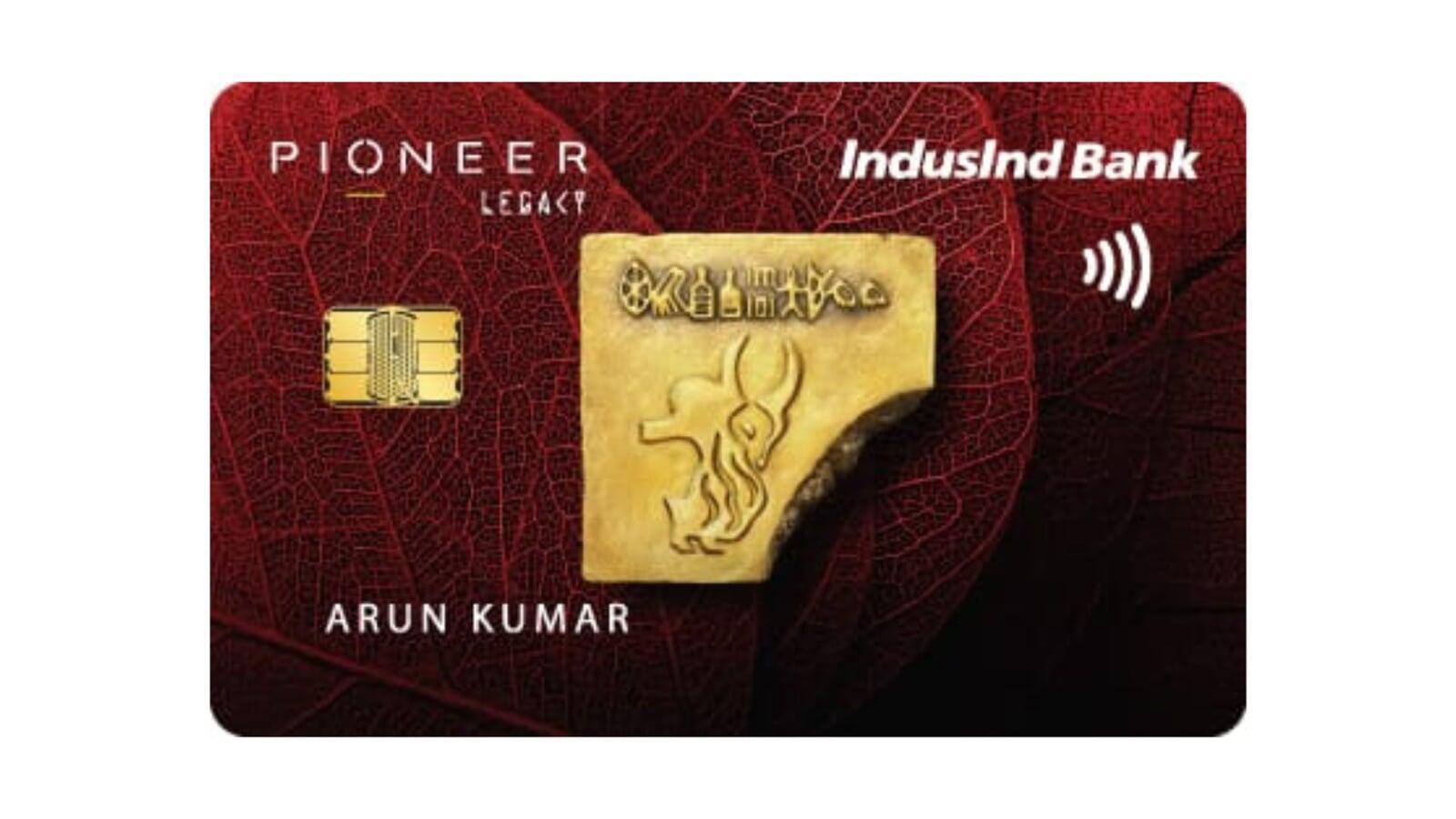

IndusInd Bank Pioneer Legacy Credit Card

Financial Expert Advice

Choose Your First (or Next) Credit Card Wisely

Maintain Two Credit Cards: One For Routine Expenses And Auto-Debits, And Another Reserved For Emergencies. Avoid Pursuing Rewards; Prioritize Financial Stability And Discipline.

IndusInd Bank Pioneer Legacy Credit Card Review:

₹1.97 Lakh Value, Golf Access & Global Lounge Network

golf benefits

- 4 complimentary games/month at participating clubs nationally (48 annually).

4 Complimentary golf lessons/month at select venues.

Movie Benefits

Buy one, get second free.

3 complimentary movie tickets per month (36 annually).

Insurance Coverage

Travel Insurance (Oriental Insurance):

Lost baggage: ₹1,00,000.

Delayed baggage: ₹25,000.

Loss of passport: ₹50,000.

Lost ticket: ₹25,000.

Missed flight connection: ₹25,000.

Total travel insurance: ₹2,25,000 aggregate coverage.

Total Protect Fraud Coverage: Insurance equal to full credit limit for unauthorized/counterfeit transactions and theft/loss (48-hour protection window).

24x7 Concierge Services

Pre-trip assistance (destination info, weather, landmarks, transport)

Hotel reservations globally

Flight booking assistance

Sports/entertainment event ticketing

Exclusive workshop/event access

Flowers and gifts delivery worldwide

Auto Assist Emergency Services

Roadside mechanical/electrical repair

Emergency fuel supply (up to 5 liters)

Flat tire repair/replacement

Lost keys/locksmith services

Battery service

Emergency towing

Accident management and medical coordination

One night Free with Mastercard

Whether it's a long weekend city-break, a week-long beach retreat or something in between, enjoy one night free with Mastercard at a collection of participating luxurious hotels to handpicked resorts, specially curated for you.

- Book one movie ticket and get another movie ticket free

- Valid for Visa Signature cardholders

- Offer is open for Thursday, Friday, Saturday, and Sunday (4 days)

- Movie ticket discount is capped at Rs 300 per transaction

This review offers a clear and balanced overview of The IndusInd Bank Pioneer Legacy Credit Card’s strengths and limitations, helping readers make an informed choice about whether this card fits their