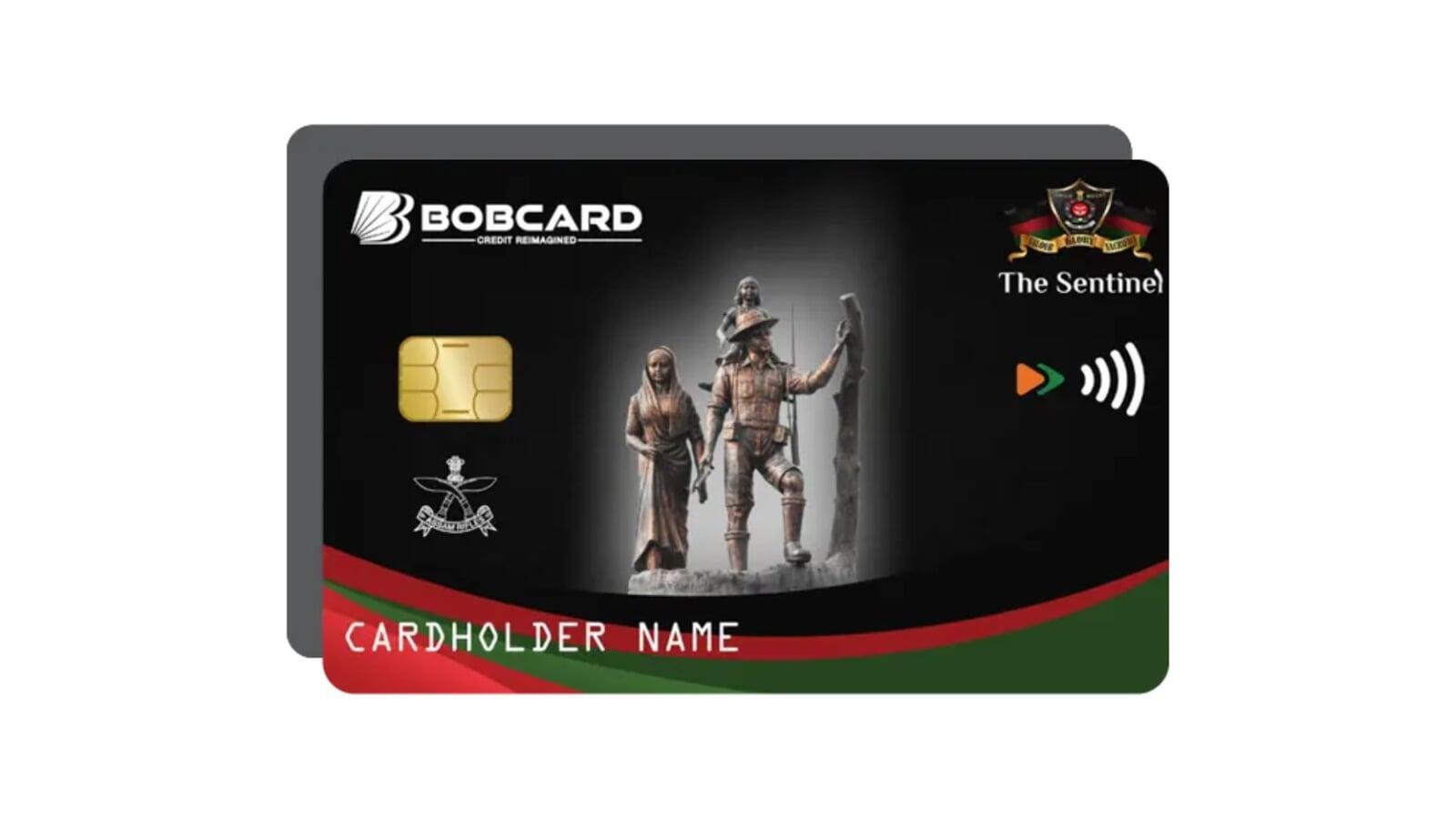

Bank Of Baroda Assam Rifles The SENTINEL BOBCARD Credit Card Review

Author And Publisher: Gyro 3.oAssam Rifles The SENTINEL BOBCARD Credit Card

Financial Expert Advice

Choose Your First (or Next) Credit Card Wisely

Maintain Two Credit Cards: One For Routine Expenses And Auto-Debits, And Another Reserved For Emergencies. Avoid Pursuing Rewards; Prioritize Financial Stability And Discipline.

Assam Rifles The SENTINEL BOBCARD Credit Card Review: Lifetime Free Northeast Defence Card with

5X Departmental Rewards, 8 Lounge Visits,

and Concierge Services

introduction

Assam Rifles The SENTINEL BOBCARD is a lifetime-free credit card crafted exclusively for serving and veteran personnel of the Assam Rifles, offering premium benefits with zero joining and annual fees. It rewards cardholders with a welcome bonus, accelerated reward points on departmental store spends, and generous complimentary domestic airport lounge access to support frequent travel. The card further enhances value with core rewards on all other spends, fuel surcharge waiver, cashback redemption of reward points, and up to three free add-on cards for family members, making it a high-utility card for the northeast guardians of India.

key features and benefits

Welcome Benefits

Lifetime Free Entry.

500 Bonus Reward Points: Credited on spending ₹5,000 or more within 60 days of card issuance.

Complimentary 6-Month FITPASS Pro Membership: Activated on card issuance; unlimited gym access to 10,000+ fitness facilities nationwide.

12 months amazon prime Membership on spending minimum 1 lakh within 90 days of the card Issuance.

Reward Structure

Departmental Stores: 10 Reward Points per ₹100 (5X base)—everyday essentials to big monthly runs.

Other Categories: 2 Reward Points per ₹100 (2X base)—covers utilities, dining, travel, online, and more.

Airport Lounge Access

8 Complimentary Domestic Lounge Visits: 2 per quarter at participating airports.

Concierge Services

24/7 Concierge Services: Domestic and international assistance, powered by RuPay.

insurance benefits

- personal accidental death cover: Air/non-air - 20 Lakhs.

additional Benefits

get upto 3 lifetime free add-on cards.

smart EMI: convert spends into EMI with smart EMI option (mini ₹2500).

50 Days Interest-Free Credit: From date of purchase to payment due date.

zero Liability on lost card (report Immediately).

contactless safe payments.

Card Essential

Practical Considerations

Fees & Charges (Summary):

- Zero cost for joining and holding; benefits unlimited for eligible users.

Eligibility:

Service or veteran Assam Rifles personnel (primary: 18–70 yrs).

Add-on eligible for spouse, parents, siblings, kids (18+).

National ID, PAN, address proof, service ID/certificate/pay slip required.

Limitations:

Exclusivity—public not eligible.

No category acceleration beyond department stores.

Lounge and concierge use subject to network/participating locations.

Redemption Options

- BOBCARD Rewards Portal:

- Direct cashback for all RPs (1 RP = ₹0.25, credited to account).

- Best Value Strategy:

Concentrate large family/official/bulk purchases at department stores.

Maximize quarterly lounge usage on travel.

Use add-on cards for spouse/parents to access all family spending.

Redeem quarterly to see tangible impact.

Ideal User Profile

Active or former Assam Rifles personnel.

Frequent domestic travelers (for lounge/concierge).

Prefer simple, zero-cost rewards and direct cashback.

Final Thoughts

Strengths:

Lifetime free.

5X departmental rewards, strong for household/essential spending.

2X base on all else.

8 domestic airport lounge visits annually.

Add-on flexibility.

24/7 RuPay-powered concierge.

Fuel surcharge waiver.

Limitations:

Reward rates favor in-person over online/utility/dining.

Lounge benefits are solid, but not unlimited.

No luxury, golf, or international focus features.

No stated insurance coverage.

Verdict:

For Assam Rifles personnel and veterans, The SENTINEL BOBCARD is a fitting salute—straightforward, no-fee, and rewards-first. Real value comes from department store spending and family utility, with meaningful travel support via lounge/concierge, and robust everyday practicality.

Additional Tips for Applicants

Confirm status (service/veteran) and complete all basic identification.

Use the card chiefly for major household runs, not only for small expenses.

Apply for add-on cards for family—no extra cost.

Pay in full monthly; avoid revolving balance charges.

Utilize concierge for travel/reservations, maximize lounge visits for family/official trips.

Redeem cashback regularly—it’s money back in your pocket!

CDMS EXPERT ADVICE

Force-exclusive credit cards honor a life of service—but they’re best enjoyed as a complement to strong budgeting and timely repayment habits. Use department store 5X rewards for genuine household expenses, never as an excuse for lifestyle inflation. Settle your bill in full every month: with no annual fee, every point you earn directly boosts your savings, but interest charges erase that hard-won value. Use your card purposefully—with the discipline that defines every Assam Rifles sentinel.

This review offers a clear and balanced overview of The Bank of Baroda Assam Rifles The SENTINEL Credit Card’s strengths and limitations, helping readers make an informed choice about whether this card fits their

Spending Habits And Financial Goals.

Gyro - Your Financial Compass Is A Constantly Updating Financial Insights Engine That Aggregates Data From Various Sources To Provide Up-To-Date insights On Banking Products. Cashon.cards Offers Blogs, Videos, And Podcasts To Help Users Make Informed Financial Decisions.