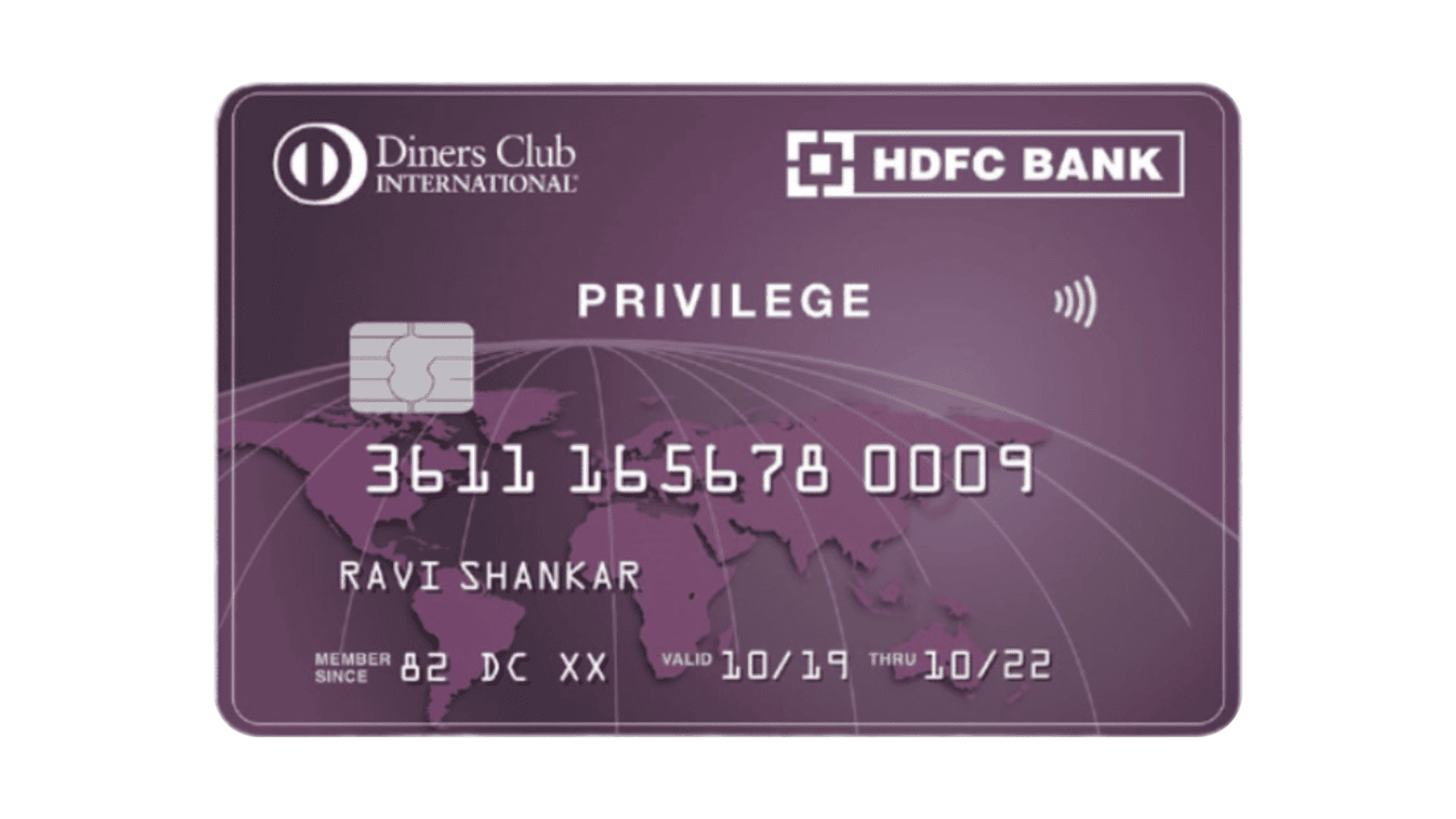

HDFC Bank Diners Club Privilege Credit Card Review

Author And Publisher: Gyro 3.oHDFC Bank Diners Club Privilege Credit Card

Financial Expert Advice

Choose Your First (or Next) Credit Card Wisely

Maintain Two Credit Cards: One For Routine Expenses And Auto-Debits, And Another Reserved For Emergencies. Avoid Pursuing Rewards; Prioritize Financial Stability And Discipline.

HDFC Bank Diners Club Privilege Credit Card Review

"Beyond the Everyday, Into the Extraordinary"

Introduction

The HDFC Bank Diners Club Privilege Credit Card is a premium lifestyle credit card designed for individuals who value rewards across various categories, including dining, entertainment, travel, and shopping. With its robust benefits package, it's an excellent choice for those seeking a versatile card that enhances their lifestyle experiences, Here’s a detailed review to help you decide if this card is right for you.

Key Features and Benefits

Welcome Benefits

- Receive complimentary annual memberships to Swiggy One and Times Prime upon spending ₹75,000 within the first 90 days of card issuance.

Reward Structure

Earn 4 reward points for every ₹150 spent on all transactions.

Earn accelerated rewards of up to 10x on HDFC Bank SmartBuy spends.

Earn 5x reward points on Swiggy and Zomato transactions.

Dining and Entertainment

Enjoy a 'Buy 1 Get 1 Free' offer on movie and non-movie weekend tickets via BookMyShow, applicable for shows on Friday, Saturday, and Sunday.

Travel Perks

Complimentary access to over 1,000 airport lounges worldwide, with 8 visits annually (2 per quarter) for both primary and add-on cardholders.

The lounge access is available upon spending ₹15,000 in the previous quarter.

Insurance Coverage

Air accident insurance cover worth $125,000*

Emergency overseas hospitalization: $31,250*

Travel Insurance Cover of up to $625 on baggage delay

Credit Liability Cover of up to 9 Lakh*

Foreign Currency Markup

3.5% + GST, approximately 4.13%*.

Eligibility

Salaried individuals must earn at least ₹70,000 per month, while self-employed individuals need an annual ITR of over ₹8.4 lakh.

Card Essential

Rewards and Benefits Analysis

The HDFC Bank Diners Club Privilege Credit Card is ideal for those who value premium lifestyle benefits, including dining, entertainment, and travel perks. The accelerated rewards on SmartBuy spends and Swiggy/Zomato transactions make it a great choice for frequent users of these services. Additionally, the complimentary lounge access enhances its appeal for travelers.

Practical Considerations

While the card offers excellent lifestyle benefits, its high annual fee and lack of fuel surcharge waiver might deter some users. Additionally, the foreign currency markup fee of approximately 4.13% can reduce the net return on international transactions.

Redemption Options

Reward points can be redeemed for flights, hotels, products, or cash credits through the HDFC Bank SmartBuy portal. The redemption value varies, with the best value obtained through flight and hotel bookings.

Ideal User Profile

This card is best suited for:

Individuals who frequently dine out or order food online

Travelers seeking premium perks like lounge access

Those who value lifestyle benefits and can meet the eligibility criteria

Final Thoughts : Insurance & Perks Included

The HDFC Bank Diners Club Privilege Credit Card offers a compelling package for those who prioritize lifestyle and travel benefits,

For ₹2,500 annually, the HDFC Diners Club Privilege Card offers valuable -> built-in insurance

(₹1Cr air death, ₹25L medical, ₹9L liability, ₹50K baggage) alongside travel and lifestyle perks, making it worthwhile for active users seeking security and premium benefits.

Additional Tips for Potential Applicants

Eligibility: Ensure you meet the income requirements.

Usage: Maximize spends on Swiggy, Zomato, and SmartBuy to get the most out of the rewards.

Redemption: Opt for flight or hotel bookings for the best redemption value.

CDMS EXPERT ADVICE

Use the HDFC Bank Diners Club Privilege Credit Card strategically—maximize SmartBuy and dining spends to unlock true value. Maintain financial discipline; if credit card dues feel overwhelming, seek timely guidance from CDMS for structured debt management and long-term financial stability.

spending habits and financial goals.

Gyro - Your Financial Compass Is A Constantly Updating Financial Insights Engine That Aggregates Data From Various Sources To Provide Up-To-Date insights On Banking Products. Cashon.cards Offers Blogs, Videos, And Podcasts To Help Users Make Informed Financial Decisions.