IDFC FIRST Activate UPI Digital Credit Card Review

Author And Publisher: Gyro 3.oIDFC FIRST Activate UPI Digital Credit Card

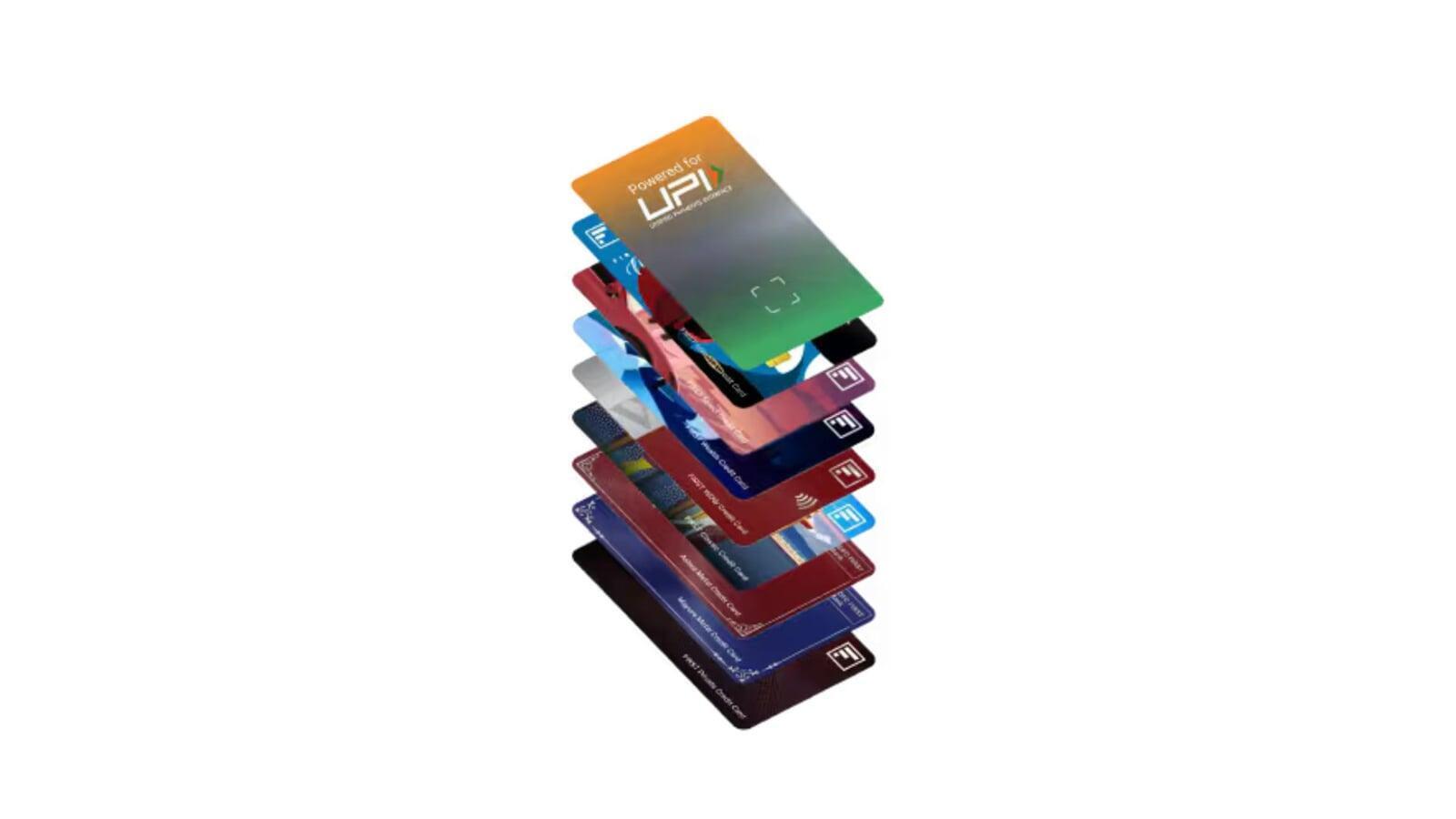

IDFC FIRST Activate UPI Digital Credit Card Review: Instantly Turn Credit Into UPI Rewards—Zero Fuss, Maximum Flexibility

introduction

The credit card landscape has evolved with UPI payments—now the IDFC FIRST Activate UPI Digital Credit Card lets you bring your credit line directly into your everyday UPI spends. This card is tailor-made for digital natives, mobile-first shoppers, and those who want instant activation, real-time rewards, and total app-based control. If you’re tired of carrying plastic and want instant value from every QR code scan, Activate UPI is the card that gives your wallet a digital-first upgrade for IDFC FIRST CREDIT CRAD HOLDER.

key features and benefits

Welcome Offer

100% cashback up to ₹200 on first 4 UPI transactions (within 15 days of card generation).

Digital-Only, Lifetime-Free Option

No physical card—entirely digital and instantly activated via mobile app.

Instant Approval and Activation

Link to your existing IDFC FIRST Bank credit card.

Get started in minutes with mobile verification.

UPI Reward Structure

3X rewards (points) on UPI spends above ₹2,000.

1X reward on UPI spends below ₹2,000 and on all utility/insurance payments*.

Common Rewards Account for your digital credit card and existing IDFC FIRST Bank Credit Card.

Bill Pay, Balance Tracking, Real-Time Management

Full control via IDFC FIRST Mobile App (Android & iOS).

Widest UPI Acceptance

Scan and pay at over 60 million+ merchant QR codes across India.

Linkable to popular UPI apps: PhonePe, Google Pay, Paytm, IDFC app.

Card Essential

Rewards and Benefits Analysis

Who Benefits Most?

- Digital-first users and young professionals benefit most, earning rewards on every UPI scan. Existing IDFC FIRST credit card holders can quickly access these features and enjoy pooled rewards, while budget-conscious users and cashback seekers get instant value with easy app-based management.

3X rewards above ₹2,000 is best for grocery shops, restaurants, and big retail bills.

1X on small spends ensures even chai and daily utility payments add up over time.

Welcome cashback is ideal for first-timers, recouping the joining fee with just a few routine purchases.

Practical Considerations

Limitations

No physical card (good for travel light, but some users may prefer plastic).

Rewards only apply on UPI merchant spends, not wallet loads/rent/fuel/cash advances.

Annual fee applies after first year (waived if you maximize cashback offer on first use).

Eligibility

Applicants must already hold an existing IDFC FIRST Bank credit card.

Register mobile number must match your UPI ID and IDFC FIRST account.

Usage Tips

Use this card for all big-ticket UPI merchant spends.

Link your favorite UPI app and check points in your main rewards account.

Pay attention to transaction size for maximizing 3X rewards.

Redemption Options

Rewards Pooling

Points from UPI digital card go into your main IDFC FIRST rewards account.

Flexible Choices

Redeem for vouchers, travel, bill credits, merchandise through the mobile app.

1 point typically = ₹0.25; use pooled points for high-value redemptions.

Best-Value Strategies

Save points for festival shopping, travel, or seasonal offers in the app.

Track expiry and redeem before points lapse.

Ideal User Profile

Digital payment enthusiasts and UPI power users.

Budget-conscious spenders seeking fast activation and instant value.

Existing IDFC FIRST Bank cardholders aiming to optimize rewards.

Tech-savvy families and professionals who prefer app-only solutions.

Final Thoughts

Strengths

Instantly live; digital, secure, and integrated with all major UPI apps.

3X rewards for high-value UPI spends.

No physical card needed; Wallet less convenience.

Easy mobile onboarding and total account control.

Weaknesses

Annual fee (from second year) unless cashback offer offsets cost.*CHECK*

Rewards limited to UPI merchant QR spends.

No travel, luxury, or lifestyle perks typical of premium cards.

Verdict

The IDFC FIRST Activate UPI Digital Credit Card is India’s top choice for digital-first spenders and app-based payment users. If you want your everyday UPI payments to earn real credit card rewards and need instant, no-nonsense activation, this card is a must-have. Apply if you prefer paying by scan, earning every rupee, and going fully digital.

Additional Tips for Applicants

Income/Eligibility

Must have an active IDFC FIRST Bank credit card; standard income/KYC applies for main card.

Documentation

Quick digital process; ensure mobile/UPI ID match your card record.

Application

Use mobile verification, complete steps in app for fastest approval.

Maximizing Benefits

Use for ₹2,000+ UPI scans; track merchant spends—avoid excluded categories.

Leverage welcome cashback to offset joining fee.

Monitor pooled points and redeem strategically in app.

Responsible Usage

Pay bills on time via app; set up autopay and notifications.

Track rewards expiry and redemption windows.

CDMS EXPERT ADVICE

UPI‑driven cards like IDFC FIRST Activate are great for squeezing extra rewards out of everyday QR spends, but using “invisible” digital credit without a clear payoff plan can quietly build expensive revolving debt. If multiple UPI‑linked cards, EMIs, or growing minimum payments are starting to pressure your monthly budget, connect with CDMS at Cashon.cards for professional, judgment‑free guidance to consolidate dues, lower interest stress, and follow a structured path to clear outstanding bills while protecting your credit health.

This review offers a clear and balanced overview of The IDFC FIRST Activate UPI Digital Credit Card’s strengths and limitations, helping readers make an informed choice about whether this card fits their

Payments Habits And Financial Goals.

Gyro - Your Financial Compass Is A Constantly Updating Financial Insights Engine That Aggregates Data From Various Sources To Provide Up-To-Date insights On Banking Products. Cashon.cards Offers Blogs, Videos, And Podcasts To Help Users Make Informed Financial Decisions.