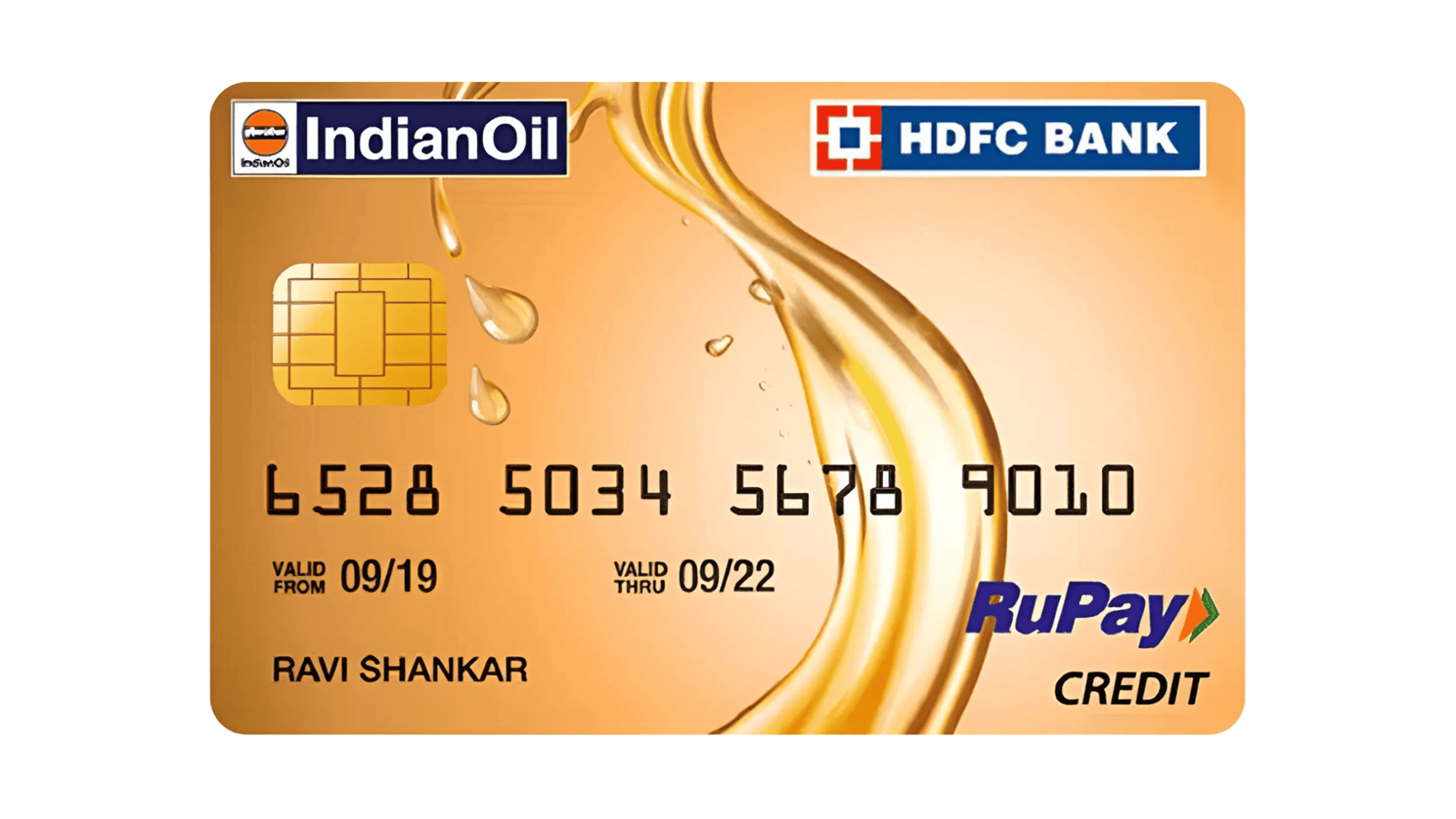

IndianOil HDFC Bank Credit Card Review

Author And Publisher: Gyro 3.oIndianOil HDFC Bank Credit Card

Financial Expert Advice

Choose Your First (or Next) Credit Card Wisely

Maintain Two Credit Cards: One For Routine Expenses And Auto-Debits, And Another Reserved For Emergencies. Avoid Pursuing Rewards; Prioritize Financial Stability And Discipline.

IndianOil HDFC Bank Credit Card Review

"Drive Further, Pay Less"

Introduction

Key Features and Benefits

Welcome Benefits

- There are no specific welcome benefits, but you can start earning Fuel Points immediately upon card activation.

Reward Structure

Earn 5% Fuel Points on spends at IndianOil outlets, grocery shopping, and utility bill payments.

Earn 1 Fuel Point for every ₹150 spent on other retail purchases.

The first six months offer up to 250 Fuel Points per month on fuel spends, and 150 Fuel Points per month thereafter. For groceries and bill payments, the cap is 100 Fuel Points per month each.

Fuel Surcharge Waiver

- Enjoy a 1% fuel surcharge waiver on transactions exceeding ₹400, with a maximum waiver of ₹250 per statement cycle.

Annual Fee

- ₹500 + GST, with the option to waive the renewal fee by spending ₹50,000 annually.

Card Essential

Rewards and Benefits Analysis

The IndianOil HDFC Bank Credit Card is ideal for frequent users of IndianOil outlets, offering substantial Fuel Points on fuel purchases, groceries, and utility bill payments. The fuel surcharge waiver and potential for free fuel annually enhance its appeal for those seeking to save on fuel expenses.

Practical Considerations

While the card excels in fuel-related benefits, its rewards structure for non-fuel categories is modest compared to other lifestyle cards. Additionally, the cap on Fuel Points earned per month might limit high spenders from maximizing their rewards.

Redemption Options

Fuel Points can be redeemed for free fuel at IndianOil outlets through the XTRAREWARDS program, offering a redemption value of approximately 96 paise per Fuel Point. Alternatively, they can be redeemed for statement credit or products, though this offers a lower value of about 20 paise per Fuel Point.

Ideal User Profile

This card is best suited for

Frequent users of IndianOil outlets.

Individuals who prioritize fuel savings and rewards on utility bill payments.

Those seeking an affordable credit card with focused fuel benefits.

Final Thoughts

The IndianOil HDFC Bank Credit Card offers a compelling package for frequent IndianOil users with its high reward rate on fuel purchases and utility bill payments. While it may not be ideal for everyone due to its limited premium benefits, its affordability and focused rewards make it a solid choice for those who regularly use IndianOil services.

Additional Tips for Potential Applicants:

Eligibility: Ensure you meet the income requirements (₹10,000/month salary or ₹6 lakh/year ITR).

Usage: Maximize spends at IndianOil outlets and on utility bill payments to get the most out of the rewards.

Redemption: Opt for free fuel redemption through XTRAREWARDS for the best value.

CDMS EXPERT ADVICE

The IndianOil HDFC Bank Credit Card is a strong choice for frequent fuel buyers aiming to save via focused rewards. Use it responsibly to avoid interest accumulation and maintain financial discipline. If credit card debt becomes overwhelming, seek CDMS expert support for effective debt management strategies.

spending habits and financial goals.

Gyro - Your Financial Compass Is A Constantly Updating Financial Insights Engine That Aggregates Data From Various Sources To Provide Up-To-Date insights On Banking Products. Cashon.cards Offers Blogs, Videos, And Podcasts To Help Users Make Informed Financial Decisions.