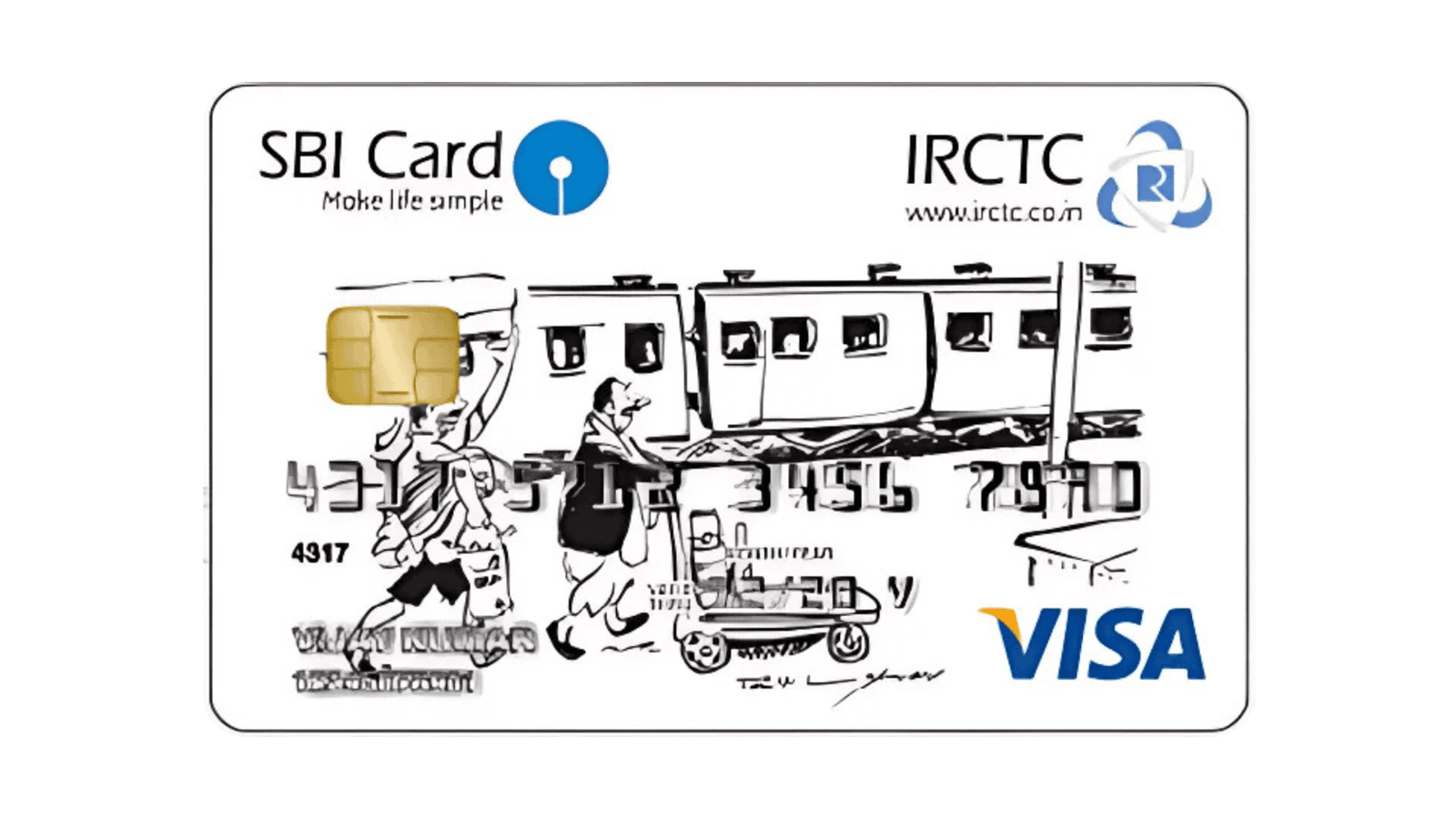

SBI IRCTC Platinum Credit Card Review

Author And Publisher: Gyro 3.oSBI IRCTC Platinum Credit Card

Financial Expert Advice

Choose Your First (or Next) Credit Card Wisely

"Limit yourself to holding two credit cards A/C—one for daily expenses and auto-debits, and another reserved for emergencies.

Avoid chasing cashback, miles, rewards or Investments, as this can distract from sound financial management;

and lead to unnecessary debt. Focus on stability & discipline."

SBI IRCTC Platinum Credit Card Review

A Comprehensive Guide

Introduction

Key Features and Benefits

Welcome Benefit

- Get 350 activation bonus Reward Points on single transaction of ₹500 or more within 60 days of card issuance.

Value Back Benefits

- Buy tickets through irctc.co.in & IRCTC Mobile App for AC1, AC2, AC3, Executive Chair car and Chair Car and earn up to 10% Value Back as Reward Points.

Reward Structure

Get 1 Reward point for every ₹125 spent on non-fuel retail purchases, including railway ticket purchases at irctc.co.in and IRCTC Mobile App (Android only).

Transaction Fee Waiver

- Enjoy a 1% transaction fee waiver on railway ticket bookings made through IRCTC.

Milestone benefits

- Earn 500 Reward Points on payment of Renewal fee.

Fuel Surcharge Waiver

- Get a 1% fuel surcharge waiver on transactions between ₹500 and ₹3,000, with a maximum waiver of ₹100 per statement cycle.

Annual Fee

- ₹500 + GST, with no annual fee waiver option.

Struggling to keep up with mounting credit card bills?

Card Essential

| Type | Reward Points |

| Welcome Benefits | 350 bonus RP on ₹500+ spend within 60 days. |

| Annual Fee | ₹1,499 + GST |

| Reward Structure | Rewards On SPENDS |

| Renewal Benefit | ------- |

Rewards and Benefits Analysis

The SBI IRCTC Platinum Credit Card is designed to maximize savings for railway travelers. The 10% value back on AC ticket bookings through IRCTC is its standout feature, ensuring significant savings for regular train users. Additionally, the reward points on everyday spends add incremental value.

Practical Considerations

While the card offers solid benefits for railway-related expenses, its rewards structure for non-travel categories is modest. The annual fee of ₹500 is affordable, making it accessible to a wide range of users. However, the lack of lounge access or milestone benefits may limit its appeal for premium travelers.

Redemption Options

Reward points can be redeemed directly on the IRCTC website or app against train ticket bookings, providing seamless value for frequent travelers.

Ideal User Profile

This card is best suited for

Frequent Indian Railways travelers who regularly book AC class tickets.

Budget-conscious users seeking low-cost credit cards with focused benefits.

Individuals looking to save on fuel and everyday expenses.

Final Thoughts

The SBI IRCTC Platinum Credit Card is ideal for budget-conscious railway travelers, offering savings on train bookings and daily expenses. While it foregoes premium features like lounge access or milestone rewards, its affordability and focused benefits make it a practical choice for frequent train users.

Additional Tips for Potential Applicants:

Eligibility: Ensure you meet the income and credit score requirements.

Usage: Maximize AC class ticket bookings through IRCTC to earn the highest rewards.

Redemption: Use reward points directly for train ticket bookings to maximize value.

This review provides a balanced view of the card’s strengths and limitations, helping readers decide if the SBI IRCTC Platinum Credit Card aligns with their

travel habits and financial goals.

Gyro - Your Financial Compass Is A Constantly Updating Financial Insights Engine That Aggregates Data From Various Sources To Provide Up-To-Date insights On Banking Products. Cashon.cards Offers Blogs, Videos, And Podcasts To Help Users Make Informed Financial Decisions.