Blog tagged as Insurance On Cards

The YES Prosperity Business Credit Card offers strong value for self-employed professionals and SMEs with travel, dining, and fuel expenses. With low fees, 8x rewards, lounge access, and a 2.5% forex markup, it's ideal for growth-stage businesses seeking practical benefits.

Author And Publisher: Gyro 3.o

22.09.2025 05:06 PM - Comment(s)

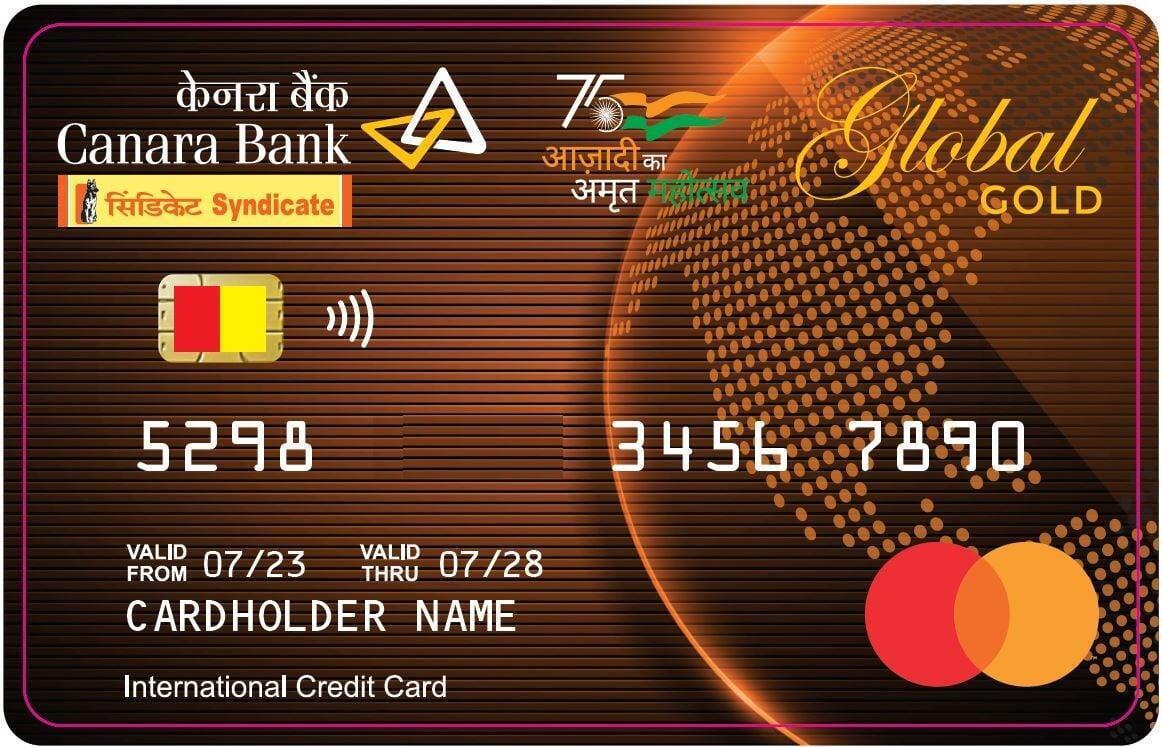

The Canara Mastercard Gold Credit Card is a lifetime-free mid-tier card offering up to ₹25 lakh credit limit, 2 reward points per ₹100, strong insurance benefits, and global acceptance. Best for regular spenders, though it lacks lounge access and charges inactivity fees.

Author And Publisher: Gyro 3.o

13.09.2025 08:28 PM - Comment(s)

The Canara VISA Gold Credit Card is a lifetime-free mid-tier card with up to ₹25 lakh credit limit, 2 reward points per ₹100 spent, global VISA acceptance, and strong insurance cover. Ideal for regular spenders, but lacks lounge access and premium lifestyle perks.

Author And Publisher: Gyro 3.o

13.09.2025 08:28 PM - Comment(s)

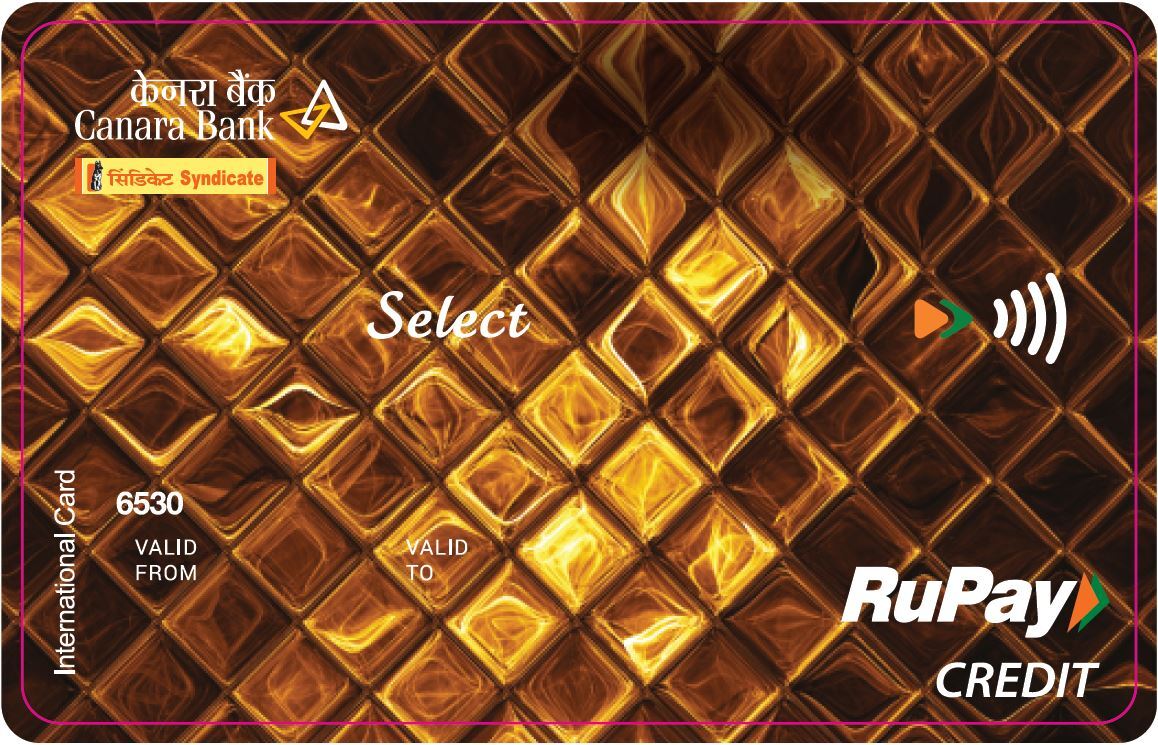

The Canara RuPay Select Credit Card is a lifetime-free card offering rewards, capped cashback on dining and utilities, lounge access, and strong insurance benefits—ideal for everyday spenders and travelers seeking value without hidden costs.

Author And Publisher: Gyro 3.o

13.09.2025 04:24 PM - Comment(s)

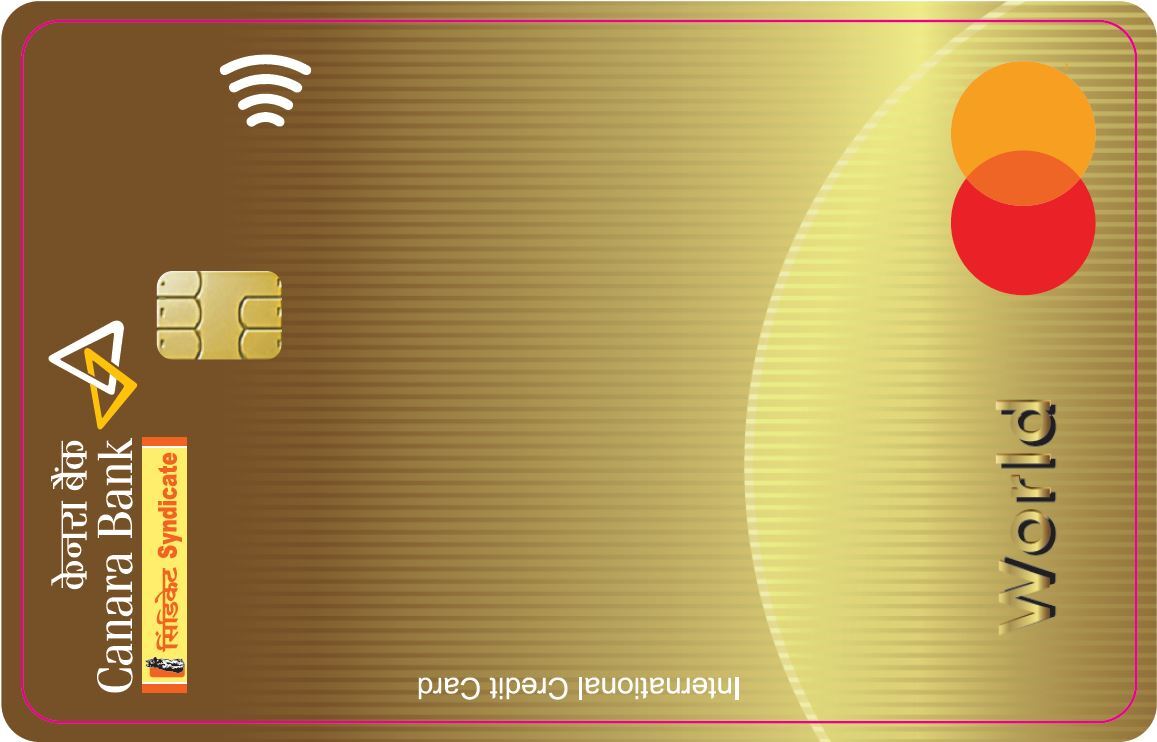

The Canara Bank MasterCard World Credit Card is a lifetime-free premium card offering 3 domestic lounge visits/quarter with guest access, 2 international visits/year, 2 points/₹100, and strong insurance cover. Best for affluent travelers, though ₹1L annual spend needed to avoid inactivity fee.

Author And Publisher: Gyro 3.o

12.09.2025 08:23 PM - Comment(s)

Discover why the Canara RuPay Classic Credit Card is the perfect starter—lifetime free, UPI-enabled, with easy EMI and key insurance benefits. Ideal for budget-conscious users wanting simple, reliable credit. Click to see if it fits your financial goals!

Author And Publisher: Gyro 3.o

09.09.2025 08:56 PM - Comment(s)

The Canara MasterCard Standard Credit Card is a lifetime free entry-level card with basic rewards, insurance coverage, and global acceptance. Ideal for first-time users and budget-conscious individuals seeking no annual fees, simple rewards, and essential protections for everyday spending.

Author And Publisher: Gyro 3.o

22.08.2025 08:36 PM - Comment(s)

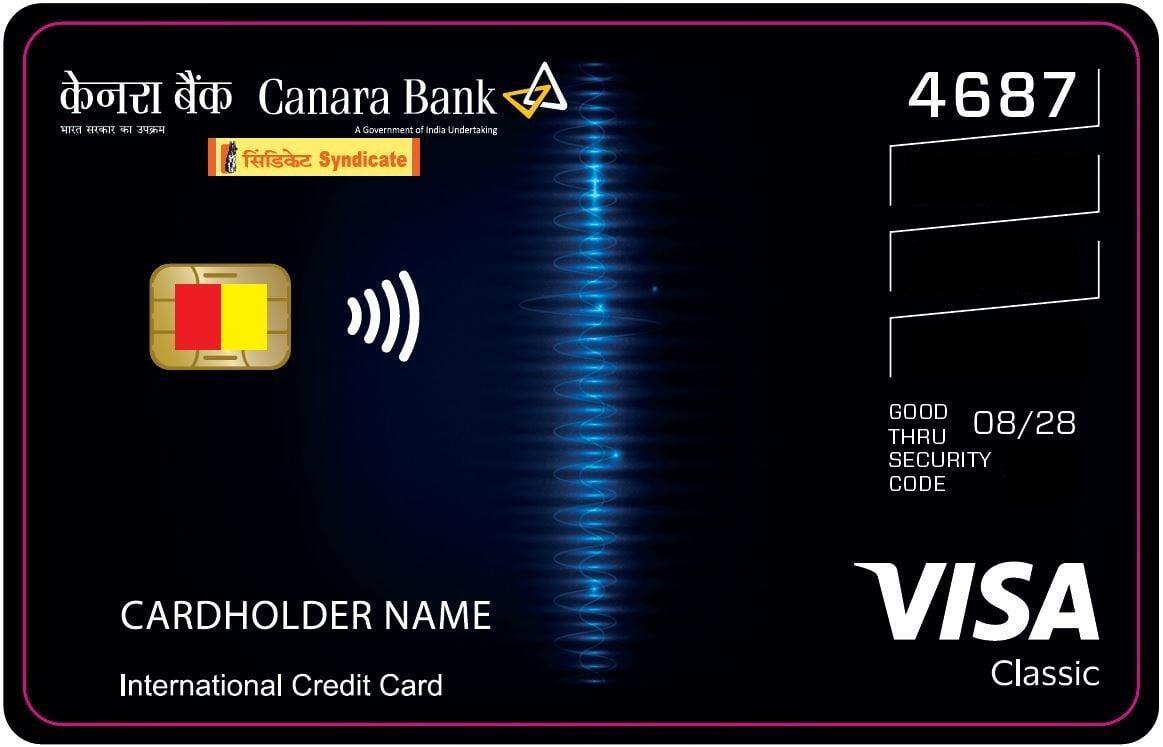

The Canara VISA Classic Credit Card is a no-fee entry-level card with basic rewards, accident insurance up to ₹4L, and global acceptance. Ideal for beginners and conservative spenders seeking simplicity, but lacks premium perks like lounge access.

Author And Publisher: Gyro 3.o

22.08.2025 08:16 PM - Comment(s)

The HDFC Bank Regalia Gold Credit Card offers 4x reward points on spends, up to 10x on SmartBuy, lounge access (12 domestic & international visits annually), milestone rewards worth ₹7,500/year, and a ₹2,500 fee (waived at ₹3L spends). Ideal for high spenders seeking premium travel perks.

Author And Publisher: Gyro 3.o

29.07.2025 09:32 PM - Comment(s)

The HDFC Bank Diners Club Black Metal Edition Credit Card offers unlimited lounge access, accelerated rewards up to 10X via SmartBuy, milestone bonuses worth up to ₹40K/year, low forex markup (2%), and premium memberships. With a ₹10K fee (waived at ₹8L spends), it’s ideal for affluent travelers.

Author And Publisher: Gyro 3.o

20.06.2025 03:46 PM - Comment(s)

The HDFC Bank Diners Club Privilege Credit Card offers 4 reward points per ₹150 spent, 5x on Swiggy/Zomato, and 8 complimentary lounge visits annually. With a ₹2,500 fee, it’s ideal for those seeking premium lifestyle benefits and travel perks, especially frequent diners and travelers.

Author And Publisher: Gyro 3.o

20.06.2025 03:45 PM - Comment(s)

Categories

- Uncategorized

(0)

- HDFC CARDS

(17)

- SBI CARDS

(16)

- AXIS CARDS

(18)

- ICICI CARDS

(21)

- KOTAK CARDS

(31)

- CANARA CARDS

(16)

- YES BANK CARDS

(20)

- IDFC FIRST CARDS

(6)

- FAQ

(0)