Blog tagged as UPI Credit Cards

The Canara RuPay Select Credit Card is a lifetime-free card offering rewards, capped cashback on dining and utilities, lounge access, and strong insurance benefits—ideal for everyday spenders and travelers seeking value without hidden costs.

Author And Publisher: Gyro 3.o

13.09.2025 04:24 PM - Comment(s)

The Canara Bank RuPay Select Secured Credit Card is a lifetime-free FD-backed card with domestic and international lounge access, insurance cover, and rewards at 0.5%. Ideal for credit builders and first-time users, though it has a 3% forex fee and ₹300 inactivity charge if spends are low.

Author And Publisher: Gyro 3.o

12.09.2025 04:06 PM - Comment(s)

The Canara RuPay Platinum Credit Card is a lifetime free card with UPI integration, lounge access, insurance, and EMI options. Ideal for beginners, UPI users, and budget travelers, but limited by modest rewards, no guest lounge access, and inactivity fee for low spenders.

Author And Publisher: Gyro 3.o

10.09.2025 02:23 PM - Comment(s)

Unlock your credit potential with the Canara RuPay Platinum Secured Credit Card. Enjoy lifetime free usage, premium lounge access, UPI-enabled payments, and comprehensive insurance coverage—all while building or rebuilding your credit. Click to discover more benefits!

Author And Publisher: Gyro 3.o

09.09.2025 10:42 PM - Comment(s)

Discover why the Canara RuPay Classic Credit Card is the perfect starter—lifetime free, UPI-enabled, with easy EMI and key insurance benefits. Ideal for budget-conscious users wanting simple, reliable credit. Click to see if it fits your financial goals!

Author And Publisher: Gyro 3.o

09.09.2025 08:56 PM - Comment(s)

The Tata Neu Infinity HDFC Bank Credit Card offers 5% NeuCoins on Tata Neu and partner brands, 1.5% on retail/UPI spends, and 8 complimentary lounge visits annually. With a ₹1,499 fee (waived at ₹3 lakh spends), it’s ideal for Tata loyalists seeking rewards and travel benefits.

Author And Publisher: Gyro 3.o

29.07.2025 09:32 PM - Comment(s)

A value-packed card for fuel and daily essentials, offering 5% savings at HPCL pumps, 20X rewards on essentials, 25% off on movies, and lounge access. Ideal for budget-conscious users who want everyday savings with a low annual fee.

Author And Publisher: Gyro 3.o

29.07.2025 09:25 PM - Comment(s)

Save up to 5% on fuel at IndianOil pumps, plus 2% on groceries and dining. Get concierge services, insurance cover, and easy fee waiver at ₹50K spend. Ideal for frequent drivers and families seeking practical rewards on essentials.

Author And Publisher: Gyro 3.o

29.07.2025 09:24 PM - Comment(s)

Lifetime-free FD-backed card for new users. No CIBIL or income proof needed. Earn 4X rewards online, enjoy interest-free cash withdrawals, and milestone perks like cashback or PVR tickets. Ideal for building credit with zero fees.

Author And Publisher: Gyro 3.o

29.07.2025 09:23 PM - Comment(s)

Kotak UPI RuPay Credit Card offers a virtual, lifetime free solution for digital spenders—enabling UPI-based credit payments, 3X reward points, and instant issuance. Ideal for tech-savvy users seeking rewards without the hassle of physical cards or annual fees.

Author And Publisher: Gyro 3.o

25.06.2025 09:25 PM - Comment(s)

The IndianOil HDFC Bank Credit Card offers 5% Fuel Points on IOCL fuel, groceries, and bill payments, with a 1% fuel surcharge waiver and up to 50 days interest-free period. With a ₹500 fee (waived at ₹50,000 spends), it’s ideal for frequent IndianOil users seeking fuel savings.

Author And Publisher: Gyro 3.o

20.06.2025 03:46 PM - Comment(s)

The HDFC Bank RuPay Credit Card offers practical benefits like UPI integration, up to 10X CashPoints on select merchants, and a fuel surcharge waiver. With affordable fees, it’s ideal for those seeking everyday rewards and secure transactions.

Author And Publisher: Gyro 3.o

20.06.2025 03:46 PM - Comment(s)

The Tata Neu Plus HDFC Bank Credit Card offers 2% cashback on Tata Neu and partner brands, 1% on non-Tata spends, and 4 complimentary lounge visits annually. With a ₹499 fee (waived at ₹1 lakh spends), it’s ideal for Tata loyalists seeking rewards and travel benefits.

Author And Publisher: Gyro 3.o

20.06.2025 03:46 PM - Comment(s)

The IRCTC HDFC Bank Credit Card offers 5 reward points per ₹100 on IRCTC bookings, 5% cashback via SmartBuy, and 8 complimentary lounge visits annually. With a ₹500 fee (waived at ₹1.5 lakh spends), it’s ideal for frequent train travelers seeking travel benefits.

Author And Publisher: Gyro 3.o

20.06.2025 03:46 PM - Comment(s)

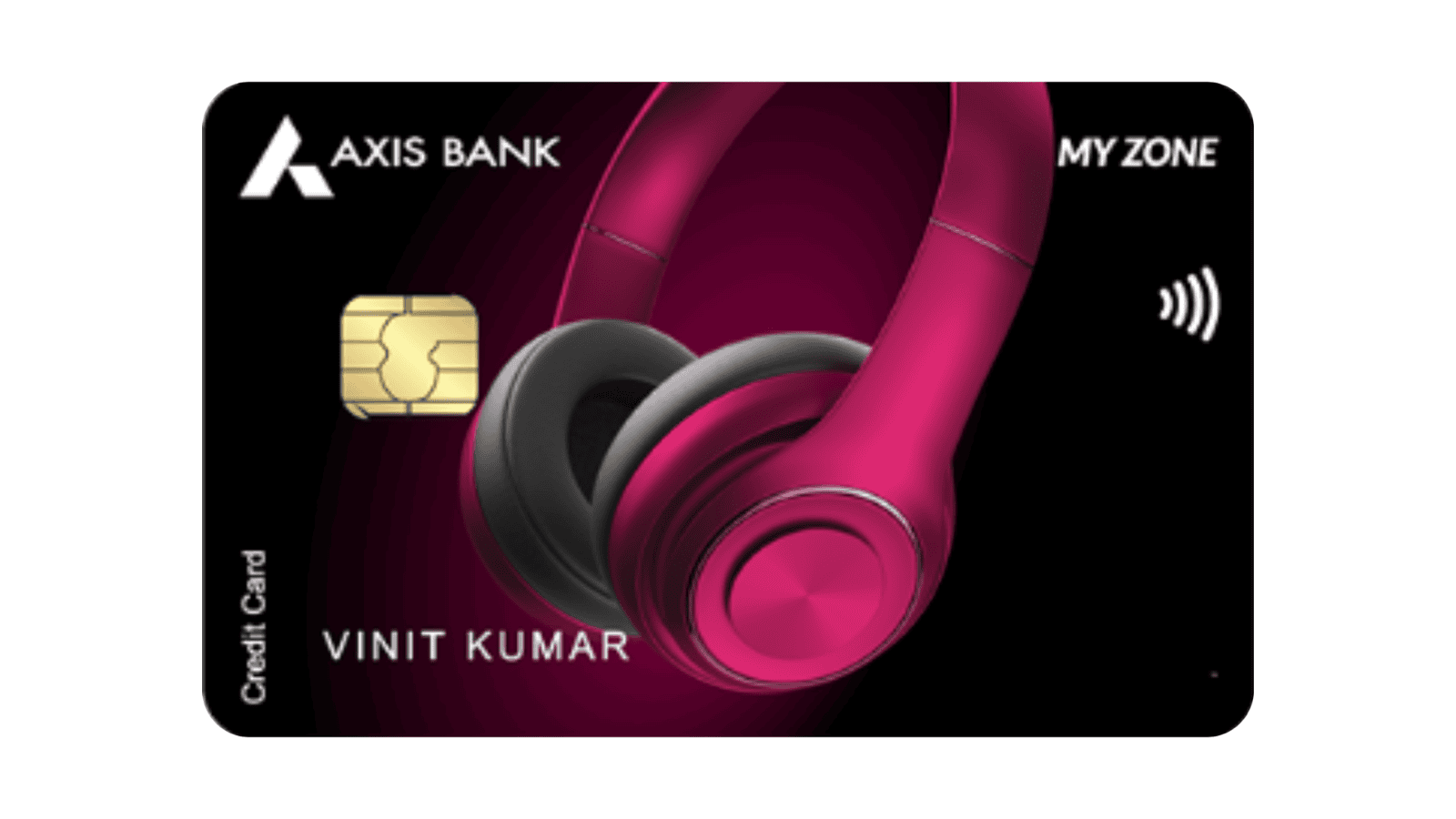

The Axis Bank MyZone Credit Card is an entry-level lifestyle card for urban users. It offers great value via discounts on Swiggy, AJIO, movies, and a SonyLIV subscription. While rewards are basic, its targeted savings and lounge access* make it a solid choice for a low fee.

Author And Publisher: Gyro 3.o

20.06.2025 03:44 PM - Comment(s)

Categories

- Uncategorized

(1)

- HDFC Credit Cards

(15)

- SBI Credit Cards

(16)

- AXIS Credit Cards

(18)

- ICICI Credit Cards

(21)

- KOTAK Credit Cards

(27)

- Canara Credit Cards

(16)

- Yes Bank Credit Cards

(20)

- IDFC FIRST Credit Cards

(15)

- IndusInd Credit Cards

(21)

- BOB Credit Cards

(24)

- Discontinued Cards

(6)

- Federal Bank Credit Cards

(9)

- HSBC Credit Cards

(11)

- Standard Chartered Credit Cards

(10)